Urbanation: Over 80% of New Condo Investors in Toronto are Facing Rental Losses

The Canadian housing market, particularly in the Greater Toronto Area (GTA), is facing its most significant test since the 1991 recession. The GTA market presents a stark contrast between its low-rise and condo sectors. While the low-rise market shows signs of stability due to limited inventory and improved sentiment stemming from recent mortgage rate trends, the condo market is grappling with recessionary pressures, with conditions deteriorating to levels not seen in decades. A major complicating factor is the high level of investor participation in the presale market, where investors have accounted for up to 70% of buyers.

Market Dynamics

Market Paralysis:

- The GTA condo market is currently paralyzed economically. The high prices of new condos relative to resale prices, rents, and interest rates make it financially unviable for investors. Developers, constrained by high development costs, cannot reduce prices to attract buyers.

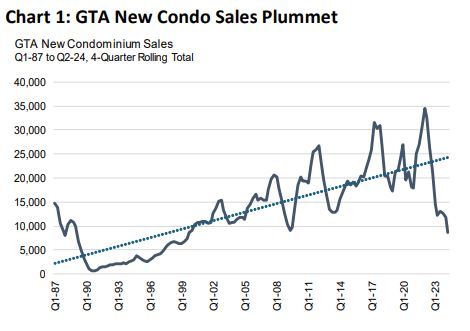

- New condo sales have plummeted, reaching their lowest levels since the late 1990s, a decline vividly illustrated by the sharp drop in new home construction in Canada’s largest market.

Presale Challenges:

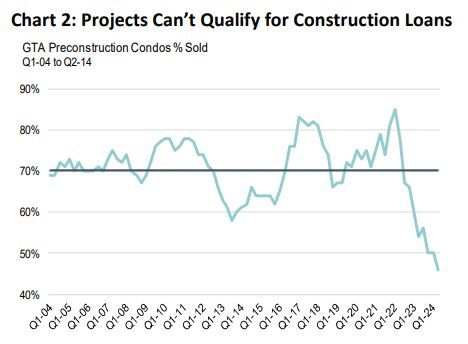

- The percentage of pre-sold pre-construction condos has fallen below 50%, a more than 20-year low. Typically, projects require at least 70% presales to commence construction, slowing down the supply pipeline dramatically. This bottleneck is expected to lead to a significant reduction in completions, worsening the affordability crisis in the coming years.

Construction and Employment Impact:

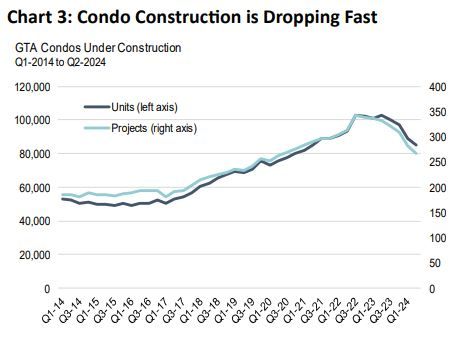

- The slowdown in condo activity has broader economic implications. Each construction crane in the GTA represents approximately 500 jobs. Since 2022, the number of condo projects under construction has decreased by at least 75, impacting nearly 40,000 jobs. This is reflected in official statistics, with construction employment in Ontario falling by 7.5% year-over-year as of June, the weakest performance since the 2008 recession, excluding the COVID-19 recession.

Interest Rates and Development Costs:

- Although construction costs have stabilized, they are no longer rising significantly on an inflation-adjusted basis and are even declining in some areas, offering temporary relief to developers. However, high interest rates persist, and the Bank of Canada is expected to continue its easing campaign, potentially lowering the overnight rate to around 2.75% by the end of 2025. This may help align condo prices with market demand eventually.

Population Growth and Policy Impact

Federal Policies:

- The federal government’s efforts to cap population growth through measures such as limiting international student admissions and reducing the number of temporary residents to 5% of the population over the next three years are expected to slow population growth in 2025 and 2026. This could ease rental market pressures but may also further dampen condo investment demand.

Investment Viability and Cash Flow

Current Investment Landscape:

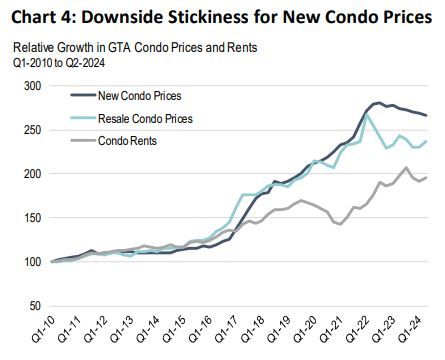

- The price gap between new and resale condos is near a record high, with new condo prices only dropping by 5% from their peak while resale prices have corrected by 12%. Rental yields remain low, barely above the risk-free rate offered by government bonds.

- For condo investments to regain appeal, resale prices and rents need to rise faster, and interest rates must decline significantly. Currently, the price differential between new and resale condos is about 60%, far above the long-run average.

Rental Cash Flow:

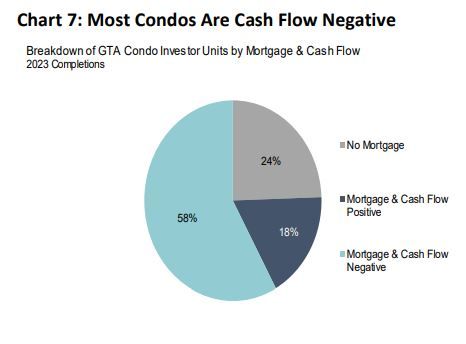

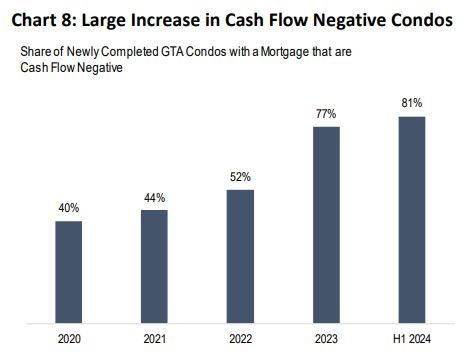

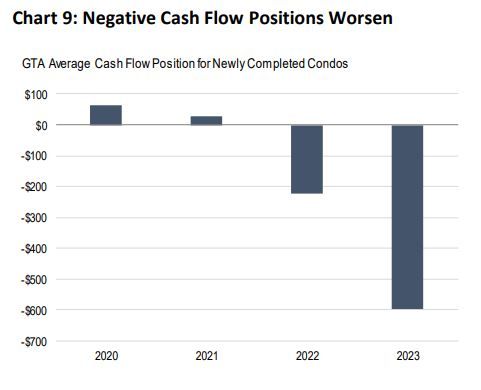

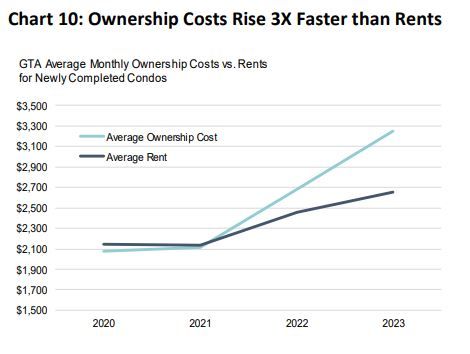

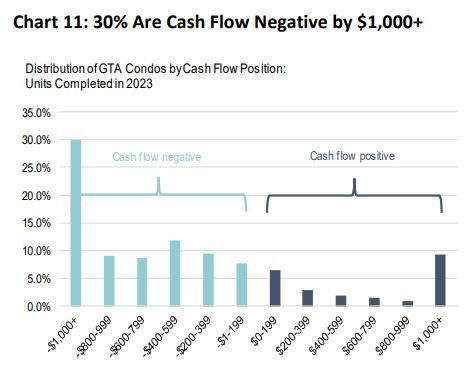

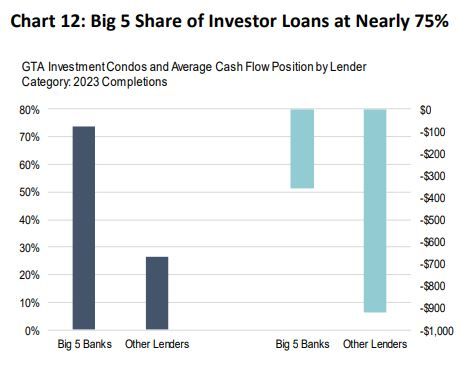

- An analysis of rental cash flow positions shows a deteriorating situation for condo investors. In 2023, 58% of new condo rentals with mortgages were cash flow negative, with the average investor experiencing a negative cash flow of $597 per month, a substantial increase from $223 in 2022. This trend has worsened in 2024, with 81% of leveraged investors in a cash flow negative position.

Investor Behavior:

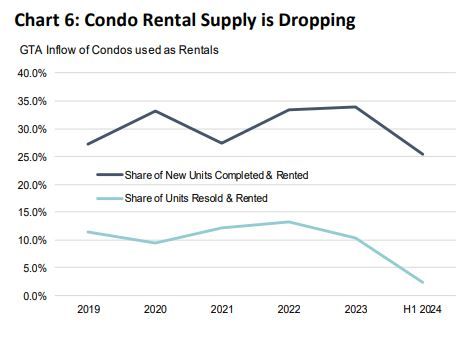

- The challenging economic environment is causing many investors to list their units for sale, contributing to a record high number of condo listings. The prevalence of investor-owned stock, built in recent years, exacerbates this trend, raising concerns about the future rental supply and the necessity to increase purpose-built rental housing.

Conclusions and Future Outlook

The GTA condo market is facing severe challenges, with new sales at historic lows and a significant number of investors encountering financial difficulties. The current market dynamics, characterized by high prices, low yields, and negative cash flow positions, suggest that the recovery of condo investments will be slow and dependent on significant changes in market conditions, including interest rates and rental demand. The emphasis on increasing purpose-built rental housing is critical to addressing the region’s housing affordability crisis and stabilizing the market.

Key Highlights

- GTA Market Split: Low-rise market remains stable; condo market in recession.

- High Investor Involvement: Investors accounted for up to 70% of presale condo buyers.

- Sales Plummet: New condo sales at the lowest level since the late 1990s.

- Construction Slowdown: Pre-sold condos below 50%, hindering project starts and reducing the supply pipeline.

- Economic Impact: Job losses in construction, with a 7.5% year-over-year decline in Ontario’s construction employment.

- Interest Rates and Costs: High interest rates and development costs continue to challenge market alignment.

- Population Growth Policies: Federal measures to cap population growth may slow demand but pose challenges for condo investments.

- Investment Challenges: High prices, low rental yields, and increasing negative cash flow for condo investors.

- Need for Purpose-Built Rentals: Essential to address housing supply and affordability issues.

Urbanation's analysis highlights the critical issues facing the GTA condo market and underscores the need for strategic interventions to stabilize the housing sector and support economic recovery.

Source: Urbanation