Understanding the Tax Implications of Adding Rental Suites to Your Home

Understanding the Tax Implications of Adding Rental Suites to Your Home

Explore the tax challenges created by recent changes in mortgage insurance rules that are encouraging homeowners to take on more debt for rental units.

Key Takeaways:

- Mortgage insurance changes: New rules encourage homeowners to create rental units by taking on more debt, leading to various tax complications.

- Change-in-Use: Homeowners converting part of their property for rental use face the "change in use" rule, which can trigger capital gains taxes.

- Deemed Disposition Rule: Converting part of a personal-use property to a rental unit triggers the "deemed disposition" rule, resulting in potential capital gains taxes based on the property's fair market value.

- Rental income: Homeowners must report rental income and navigate complex deductions and capital cost allowance (CCA) rules.

- Principal residence exemption: Future tax exemptions only apply to the personal-use portion of the property, not the rental portion.

- GST/HST concerns: Building certain types of rental units, like laneway homes, could result in significant tax liabilities.

- Tax Complexity: Homeowners risk facing unexpected financial consequences from tax rules related to converting a personal residence into a rental unit, highlighting the need for professional tax advice.

Taking on More Debt: Is It Really the Solution to Canada’s Housing Crisis?

In response to the growing housing crisis, the federal Liberal government has introduced new policies that allow Canadian homeowners to take on more debt in exchange for creating rental units within their homes. The aim is to boost housing supply, but this solution brings with it a host of tax issues that homeowners need to fully understand before committing.

Mortgage Insurance Rule Changes: The Push to Create Rental Units

Under the new policy, homeowners can borrow more money by altering their homes to create rental units such as basement suites or laneway homes. These units must be fully self-contained and comply with local zoning laws. While this might sound like a step in the right direction to ease housing shortages, the tax complications can create unforeseen financial burdens.

One such burden is the deemed disposition rule under the Income Tax Act, which treats part of a converted property as having been sold for tax purposes, even if the homeowner hasn’t actually sold their home.

Understanding the Deemed Disposition Rule

The deemed disposition rule is a central tax implication when converting part of a personal-use home into a rental unit. Under this rule, the Canada Revenue Agency (CRA) deems that there has been a "change-in-use" to the portion of the home converted for rental purposes has been disposed of at fair market value at the time of conversion.

This "phantom sale" means that homeowners could be liable for capital gains tax on the rental portion of their home based on its current market value. For example, if 30% of your home is converted into a rental unit, the CRA considers that 30% of your home has been "sold," even though you continue living there.

Example of a Deemed Disposition Calculation:

This deemed disposition can trigger capital gains taxes if the home has appreciated in value since it was purchased. Homeowners who are unaware of this tax rule may face large, unexpected tax bills.

What About the Principal Residence Exemption (PRE): Can It Help?

One potential way to minimize the capital gains tax triggered by the deemed disposition is by using the principal residence exemption (PRE). This exemption allows homeowners to avoid paying capital gains taxes on the sale of their primary residence. However, after the change-in-use, the exemption may only apply to the portion of the property that remains for personal use and not the rental portion. In some scenarios, the rental portion may still qualify for the PRE, but only if it meets specific guidelines as set out by the CRA.

CRA Guidelines on Principal Residence Exemption

According to CRA Income Tax Folio S1-F3-C2, in order for the entire property to remain eligible for the PRE, the following conditions must be met:

Ancillary Rental Use

The CRA allows homeowners to retain their entire property as a principal residence (and avoid a deemed disposition) if the rental use is considered "ancillary" to the main use of the property as a residence. This typically means that the rental portion is small compared to the personal-use portion and does not constitute a significant part of the property.No Structural Changes

The rental unit should not require any structural change to the property. If homeowners renovate or alter the home to create a self-contained rental unit (like a basement suite with a separate entrance), the principal residence exemption may no longer fully apply.No Capital Cost Allowance (CCA) Claimed

The homeowner must not claim capital cost allowance (CCA) on the rental portion of the property. Claiming CCA allows for depreciation deductions on the rental portion, which reduces current taxable income but also complicates future tax liability. If CCA is claimed, it could disqualify the rental portion from being eligible for the principal residence exemption when the property is eventually sold.

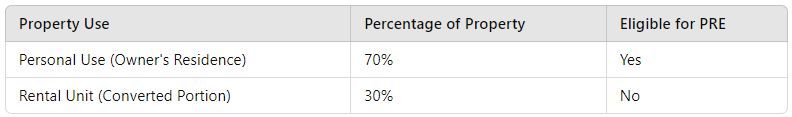

Given that the intended use of the mortgage financing is to construct new rental units, it is likely that the property will require structural changes to add a new rental unit, all but assuring rental portion of the property will no longer be eligible for the PRE. For example, consider a property where 30% of the property is converted to rental use, and, structural changes to the property were required to create the rental unit. In this scenario, only 70% of the property would remain eligible for the PRE for future dispositions.

Example of PRE Application, Post-Conversion

GST/HST Implications: A Hidden Risk

Another often-overlooked tax consequence of converting part of a home into a rental unit involves GST/HST. Specifically, if you build a laneway home, and rent it out for long-term use, you could be liable for significant GST/HST charges. This can be a complicated issue, even for seasoned tax veterans, and it is recommended that you consult with a leading tax expert on this matter. More discussion about the GST/HST implication of constructing secondary housing units can be found in my article here.

Noah Sarna, a leading expert in commodity taxes, warns that this tax trap can catch homeowners off guard. Although basement suites usually do not trigger these tax consequences, more substantial constructions, like laneway homes, often do.

Weighing the Risks: Is More Debt the Solution?

The government's new policy may seem like an opportunity for homeowners to help address the housing crisis while also generating rental income. However, encouraging people to take on more debt without fully understanding the tax consequences is risky. Homeowners could face steep taxes from the deemed disposition rule, limitations on the principal residence exemption, and potential GST/HST liabilities.

Moreover, this approach adds to a long list of government interventions in the housing market, which have often done more harm than good. Economist Thomas Sowell famously remarked, “It was the free market that once made housing affordable, before government intervention made it unaffordable.” The complexities created by new rules like these further validate this argument.

The Bottom Line: Think Before You Act

Creating rental units within existing homes might seem like a win-win scenario for solving the housing crisis and generating extra income. However, the deemed disposition rule, implications on the principal residence exemption, and potential GST/HST liabilities present significant tax risks that homeowners should carefully consider.

Before making any changes, it is crucial to consult with tax professionals who can provide clear guidance on the tax and financial implications. Understanding these rules in advance could save you from hefty tax bills down the road, making the decision to convert part of your home into a rental unit one that is both financially and tax-efficient.

Disclaimer:

This summary is for informational purposes only and should not be construed as tax advice. Tax laws are complex and subject to change. The application of tax rules may vary based on individual circumstances. It is highly recommended that you consult a qualified tax professional or advisor for specific advice regarding your unique situation and to ensure compliance with applicable tax laws and regulations.

Source: Financial Post